Whether you are looking to buy or sell a home in the New Orleans metro area (or anywhere in the state), you will find yourself staring at a Louisiana Residential Agreement to Buy to Sell. Your real estate agent may call it a “purchase agreement.”

This nine-page document covers all the pertinent details and offers plenty of room for negotiations. We will tackle this agreement, section by section, so you know what you’re signing and agreeing to BEFORE you have a fully legal and executed contract.

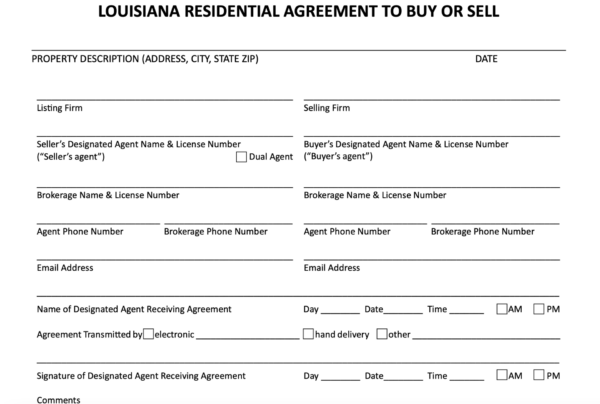

Section 1

This portion of the contract holds all agent and brokerage information, including phone numbers, email addresses, and license numbers. If your real estate agent represents both sides of the agreement, the box for dual agency must be checked. Please make sure you understand what dual agency is before agreeing to it.

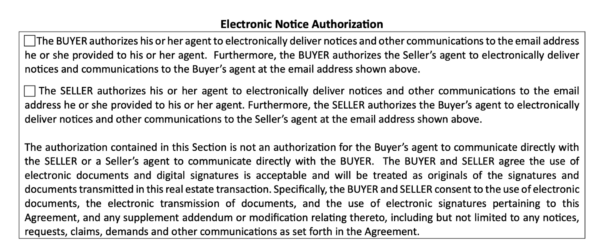

Section 2

This portion discusses the electronic communication of the contract. All notices, demands, changes, or anything related to the agreement must be in writing. Both parties agree to electronic documents and signatures, which will be treated as originals. (if the boxes are checked) They both agree that they consent to the use of electronic records, the transmission of these documents, and the use of digital signatures. This also includes any addenda, amendments, and notices of this contract.

This does NOT allow the buyer’s agent to communicate directly with the seller and vice versa.

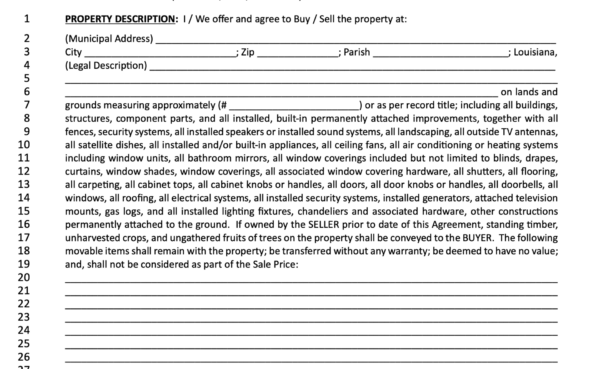

Section 3

Lines 2-7: The property address, legal description, and lot size are listed here. It’s always important to double-check the municipal address and lot size. The wrong address has been recorded on the house previously!

Lines 7-19: This contract portion states what items automatically remain with the house. (This can be changed and is negotiable.) Items that should stay with the home are landscaping, air conditioning, built-in appliances, and Ring doorbells. Most people don’t realize that window treatments are all a part of the contract! This means the blinds, curtains, and hardware should all remain with the home.

The other surprise item is that light fixtures and chandeliers remain in the house. Though some sellers will state that certain things do not stay, they must leave these items if they do not disclose this and add it to the contract.

If the seller owned any standing timber, unharvested crops, or ungathered fruits before this agreement, they go to the buyer.

Lines 20-26 allow you to write any movable items you want to remain in the house. The most common items listed here are the refrigerator, washer, and dryer. It is vital to list all the items you would like to remain, even if the listing description states they are staying. Without it being written into the contract, any movable items can be removed before closing. While the verbiage before these lines states that appliances shall remain, we have seen many disputes, and always recommend being specific.

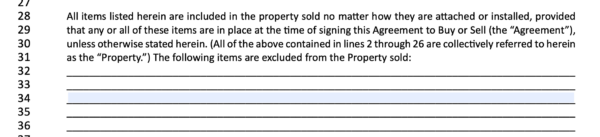

Section 4

This portion of the purchase agreement lists any items that do not remain with the property and would typically not be removed. For example, if a seller wants to keep a light fixture, it should be noted that it will be excluded from the sale.

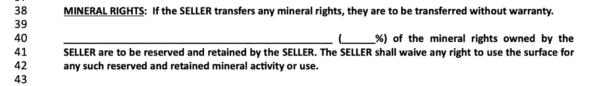

Section 5

Mineral rights rarely come into play for property in New Orleans or the metro area. This is typically reserved for land in areas where oil production is ongoing. In these situations, sellers like to retain their mineral rights on land with oil or that could potentially have oil.

In New Orleans, we usually write that the seller will keep 0% of the mineral rights.

In rare cases where the seller is fighting to keep them, they expire after ten years of non-use, and they cannot access the “minerals” by going onto your land. This means they would have to drill from the side of the property to get the goods.

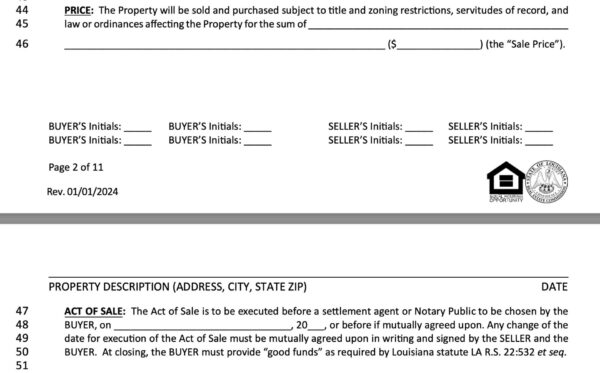

Section 6

Lines 44-46 are where the sales price is negotiated. This price covers the building and the land.

The “act of sale” or closing date for this sale is agreed upon from lines 47 through 50. You agree that the buyer can bring funds and purchase the property from the seller by this date. A notary public or settlement agent must do this. Most homebuyers choose to go through a reputable title company to perform the act of sale. The property purchaser decides what company or person will handle the closing transaction.

Section 7

The buyer will take possession of the property, and all keys and access will be given at the act of sale. The possession date would only differ if the buyer and seller agree on a different arrangement.

Lines 56-59 cover if the buyer has to sell another property to purchase this one. If the buyer needs to sell their other property, a contingency addendum should be filled out and attached to the purchase agreement.

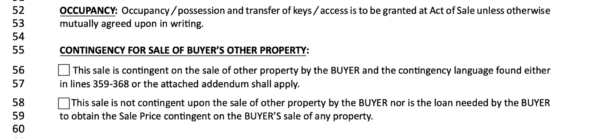

Section 8

The contract’s financing portion will state whether the purchaser is using cash or if this is a financed sale.

If the buyer is financing this sale, their agent will need to fill out the percentage of the sales price they are financing, the initial interest rate of the loan, the length of the mortgage, and the type of loan. Any discount point information should also be listed.

In lines 77-80, you may list other financing conditions. This is where any seller concessions (meaning when the seller agrees to pay a portion of the closing costs or to provide any credits to the buyer at closing) are written.

Section 9

This is the buyer’s portion of the purchase agreement that affirms they have the funds to buy this home. These funds include the down payment, closing costs, deposits, and other items.

Also noted is that even if the sale is financed, any terms or conditions in place by the buyer’s lender will not affect the property’s sale.

The most noteworthy lines (lines 87-90) require the buyer to provide the seller with written proof from their lender that the buyer has applied for their loan and authorized their lender to proceed with the loan approval process. Typically, in the New Orleans area, the buyer will be granted 5-7 days to obtain this.

If the buyer does not provide this information, the seller can cancel the contract.

Lastly, if the buyer cannot get financing, the seller can opt to provide all or some of the mortgage at the terms listed earlier in the contract.(This is extremely rare)

Section 10

All real estate taxes, HOA and/or condo dues, and assessments will be prorated at the act of sale. This means that the property seller will provide the buyer with the money to cover their property taxes from the time they lived in the property that year till the date of transfer.

This means that in all Parishes where taxes are paid in arrears (i.e., all Parishes except for Orleans), the seller must reimburse the buyer for their used portion of the tax bill.

If the buyer wants to assume the seller’s flood insurance, they are still responsible for providing the seller with the unused portion of the flood insurance.

Act of sale costs, also known as title fees, and other costs incurred from a financed sale are the buyer’s responsibility unless negotiated differently.

The seller must pay their own closing fees, which typically include the costs associated with canceling mortgages and other liens, any transfer taxes imposed by the local municipality, all unpaid municipal taxes, and any legal work necessary to clear the title to the property. The seller must also pay all outstanding HOA or condo dues and special assessments currently against the property. (NOTE: Any upcoming special assessments will be the buyer’s responsibility, so it is important to investigate this.)

Section 11

Whether or not the property’s sale is conditioned on an appraisal must be notated on lines 113-122.

If the sale hinges on an appraisal, it must appraise for no less than the sales price. The seller must keep utilities on and provide access.

If the property appraises at or above the sales price, the buyer will pay the sales price listed in the contract. It’s important to note that the buyer does not have to provide the seller with a copy of the appraisal at this time.

If the property does not appraise at the contract price, the buyer must provide the seller with a copy of the appraisal. They must provide this copy within the number of days negotiated on the contract. (This is typically three days)

The buyer should also include a written request to reduce the sales price when delivering the appraisal and the notice of low appraisal.

After the seller receives a copy, the buyer has the negotiated number of days to pay the agreed-upon sales price BEFORE the appraisal or cancel the contract. The seller also has the option to agree, in writing, to reduce the sale price either to the appraised value OR to a new agreed-upon price. (Don’t forget that everything is negotiable!)

Section 12

Once both parties agree upon and sign the purchase agreement, the buyer must deliver the deposit within 72 hours. This section negotiates whether or not the deposit must be certified funds, the amount of the deposit, and who will hold it.

If the deposit will not be held by a brokerage (which has standards different from those of third parties), the buyer and seller must sign off stating that they have read and understood these terms. The Louisiana Real Estate Commission no longer has jurisdiction over these funds. If there is a dispute and both parties acknowledge, the brokers are not required to release a deposit when held by this third party.

If both parties choose to allow a third party to hold the deposit, an additional addendum is no longer required as the information is now spelled out in the contract.

Not delivering the deposit breaches the contract, and the seller has the option to void the agreement.

When a broker holds the deposit, the deposit must be held in an escrow account that complies with the Louisiana Real Estate Commission’s rules.

If a dispute arises or no act of sale occurs, the broker must abide by the rules of the LREC to release the monies to either party.

Section 13

The buyer must receive a refund of their deposit when any of the scenarios listed in this section occur. These scenarios are as follows:

- If the buyer cancels the contract during the due diligence/inspection period

- If the buyer is unable to obtain the financing stated in the contract

- If the seller cancels due to the buyer not providing the documentation stating they have moved forward with their loan application

- If the property does not appraise for the sales price and the seller refuses to reduce the price to the appraised value.

- If the buyer cancels in a timely fashion after receiving the leases or assessments

- If the seller cannot provide timely approved sewage and/or water inspection

- If the seller will not repair/replace the sewer system following the septic/water well addendum

- If the seller will not repair/replace the private water well system per the septic/water well addendum

Section 14

The property’s sale is conditioned on the buyer receiving copies of any and all written leases and unpaid special assessments. These documents must be delivered to the buyer within 5 days of the contract being executed.

The buyer will then have five days from receipt to inform the seller if these leases/assessments are acceptable. If they are not, the buyer should deliver a cancellation.

All leases, keys, and deposits will be transferred to the buyer at the act of sale.

Section 15

Lines 177-181 are when the buyer acknowledges they have made an offer on the said property based on the condition they can see. The seller is not obligated to make any repairs – even if required by the lender. The seller is only responsible for maintaining the property in the same or better condition.

Section 16

This piece of the contract is all about your inspection/due diligence period.

Lines 183-210 further discuss the inspection period. The buyer shall have whatever amount of days are negotiated (usually 10-14 days) beginning the day AFTER the agreement is signed.

All inspections are made at the buyer’s expense, and the buyer is responsible for choosing who to bring out. The contract also lists some of the various inspections the buyer may get, but they are not limited to the ones listed.

The buyer also acknowledges that they are responsible for confirming school districts, flood zones, current zoning, etc. during this time.

All inspections and testing must be non-destructive, meaning you cannot open any walls or harm the property in any way.

The seller must also maintain the utilities during this time. If the utilities are not on or access is not given, the inspection period will extend by the same number of days the utilities were off or entrance was denied.

If the buyer is unhappy with the property’s condition after inspections, they have two options.

Lines 212-236: If the buyer is unsatisfied, they may do one of the following items:

- Cancel the contract

- List deficiencies and what remedies they desire and present them to the seller. The seller then has 72 hours to review the requests.

If the seller chooses not to make any repairs or provide credits (or only agrees to some of the items) asked for, the buyer may then, within 72 hours of the seller’s response:

- agree to what the seller has offered

- accept the property in the current condition

- cancel the contract

If the buyer does not write their reply to the seller’s response, the contract is then null and void. The buyer is still entitled to their deposit being returned.

If the seller agrees to all the repair items and/or credits that the buyer requested, the contract automatically moves forward, and the buyer cannot cancel without penalty.

NOTE: If the buyer is dissatisfied with the inspection results but fails to either provide the seller with a list of deficiencies or cancel the contract in writing within the due diligence period, then they will have effectively accepted the property in its current condition. The seller is not required to make any repairs other than those agreed upon in writing.

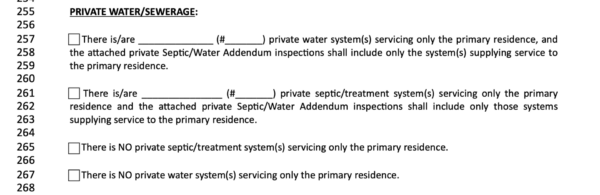

Section 17

This excerpt covers any private water or sewage. If there is a septic tank, private treatment system, or private water system, it must be indicated here.

For most properties in New Orleans, we would check that there is NO private septic/treatment system.

If there are, an additional addendum must be attached.

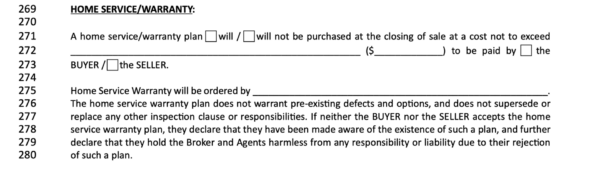

Section 18

In this segment, a home warranty is discussed. If the buyer wants the seller to provide a home warranty, they should notate that in the appropriate boxes. The amount that the seller agrees to pay for the home warranty premium must also be included.

It also explains that a home warranty does not cover pre-existing defects and should not replace inspection responsibilities.

If both the buyer and seller opt out of the home warranty plan, they have been made aware of it. Furthermore, they will not hold the agent/broker responsible or liable for any plan rejection.

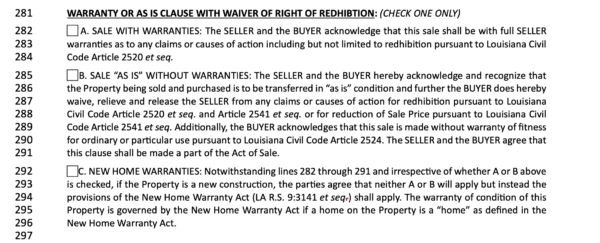

Section 19

In this portion of the contract, the buyer will need to check one of the following boxes:

- Sale with warranties occurs when the seller personally warrants the property’s condition or, in other words, affirms that they will be liable for any defects discovered in the property. It is very unusual for a seller to agree to a sale with warranties, and it is not customary in Louisiana.

- Sale “as is” without warranties: in this situation, the buyer and seller both acknowledge the property will be sold in its current condition, and it’s releasing the sellers from any other claims after the transaction is completed. The only exception for this is if the seller committed fraud.

- New home warranties: any new construction in Louisiana falls into this category and is covered by the New Home Warranty Act.

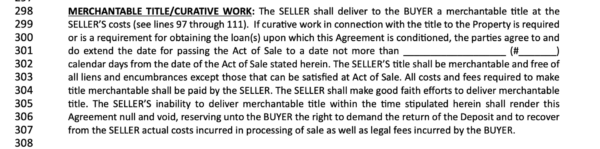

Section 20

The seller agrees to provide the buyer with a “clear” and merchantable title, meaning that the buyer can resell this property later.

If issues with the title are discovered during the title examination, both parties agree to extend the closing day by the negotiated number of days so that the necessary curative work can be done to clear the title. This extension period typically ranges from 15 to 45 days, but the parties can agree to any amount of time.

The seller’s title must be free of any liens except those that can be cleared at the time of sale.

If the seller cannot provide merchantable title within the time frame, the buyer can cancel the contract, recoup their deposit, and have the seller cover the costs incurred while processing the sale. (inspection fees, legal fees, etc.)

Section 21

Within 5 days before the Act of Sale, the buyer has the right to re-inspect the property to ensure it is in the same or better condition than it was during their initial inspection and that any agreed-upon repairs were made.

The seller must also keep utilities on for the final walk-through and provide access.

Section 22

This section details what happens if the buyer or seller defaults on the contract.

If the seller defaults, the buyer has the following options:

- Cancel the contract and have their deposit returned

- Sue the seller for specific performance. This means that the buyer will attempt to get a Judge to order the seller to proceed with the sale of the house to the buyer.

- Cancel the contract and sue for 10% of the sales price

The seller may also be liable for paying the commissions due to the brokers.

If the buyer defaults on the agreement, the seller has the following options:

- Cancel the contract and retain their deposit

- Sue the buyer for specific performance and try to force them to buy the home.

- Cancel the contract and sue for 10% of the sales price

The buyer may also be liable for paying the commissions due to the brokers.

In a lawsuit, the losing party must pay the prevailing party’s attorney fees and costs.

Section 23

Lines 335-339 are to inform you about mold-related hazards. By initialing this page of the contract, the buyer acknowledges that you have the link and can get more information regarding mold and its associated risks.

Lines 341-346 educate you on where to find information regarding the state sex offender and child predator registry.

Lines 348-349 offer the link for the FEMA flood maps and other information.

![]()

Section 24

This section tells you that the contract will be interpreted by Louisiana law. Even if the buyer or seller lives in another state, this will be governed by Louisiana state law.

Section 25

Deadlines are final; however, changes can be made with amendments as long as all parties sign off on them.

This contract is based on calendar days, not business days, and it ends at 11:59 pm, Louisiana time.

Section 26

In this area of the contract, you can write any other terms and conditions you may have for the contract. This can vary by various clauses but can also be left blank.

Section 27

This part of the purchase agreement covers the roles of your broker and/or designated agent.

First, it informs the buyer and seller that the agent is bringing the parties together to buy and sell a piece of property. The agent cannot force, nor promise, either party to perform what is outlined in the contract. The agent also offers no warranties whatsoever unless they are stated in writing.

Second, agents and brokers do not make warranties about lot size, house size, square footage, zoning, or property lines.

The buyer is responsible for discovering all the information they deem important about the property.

The buyer cannot rely on the agent to perform inspections or select who they use for inspections. They will choose who they would like to perform inspections on the property.

When an agent does provide names for assistance with inspections, the agent is NOT responsible for their services and does not warrant them.

The agent also cannot warrant that the seller has disclosed all the property’s defects.

Agents and brokers do NOT research the status of permits, zoning, codes, HOA rules, insurability, or covenants. It is the buyer’s job to investigate this information for the property they are purchasing.

Lastly, brokers and agents do not guarantee whether the property is in or out of the government’s 100-year flood plan or classified as wetlands. They also do not warrant whether the property has any wood-destroying insects (Or has had damage from them previously, either!)

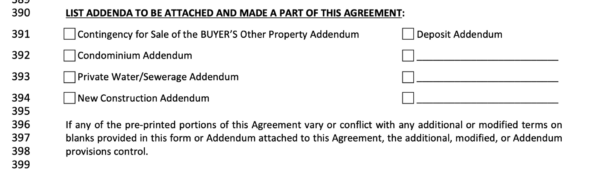

Section 28

Lines 369-374 are where you indicate if any addendums are attached to the contract.

If any addendums modify terms on the contract’s blank sections, the addendum will trump what is on the contract.

![]()

Section 29

The contract states that the words BUYER and SELLER can mean plural, singular, masculine, feminine, or neutral.

Section 30

Acceptance of this contract needs to be in writing, and electronic signatures are acceptable.

The original of this agreement must be delivered to the listing broker’s firm. However, any additional addendums or other changes will all be considered one with the agreement. This includes photocopies, faxes, and other electronic transmissions.

Section 31

This portion discusses the communication of the contract. All notices, demands, changes, or anything related to the contract must be in writing.

Acceptable ways of giving these notices are through:

- hand delivery

- overnight delivery

- fax

- e-signature transmissions (addressed to the correct parties of the contract)

- written on the first page of the agreement

- other ways that the parties have agreed upon by written notice

Section 32

READ YOUR CONTRACT. This legal document is binding once both buyer and seller sign. If you do not understand it, seek the help of an attorney before signing.

This contract is the agreement between the buyer and the seller, and any other agreements made previously that are not a part of the contract in writing are considered null and void.

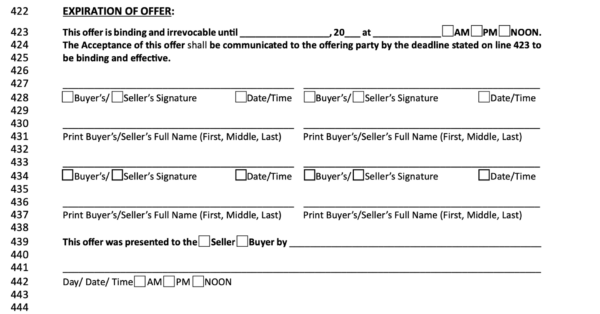

Section 33

This is the last section of the contract, and it is when you provide the other party with the contract’s expiration date.

The person presenting the contract to the other party states it is binding and cannot be changed until the date and time presented.

For the contract to be legally binding for both parties, the other party must accept it within the time frame presented in the contract.

The party presenting must sign and date the contract.

There are also lines for buyer and seller agents to annotate when they present the offers to their clients.

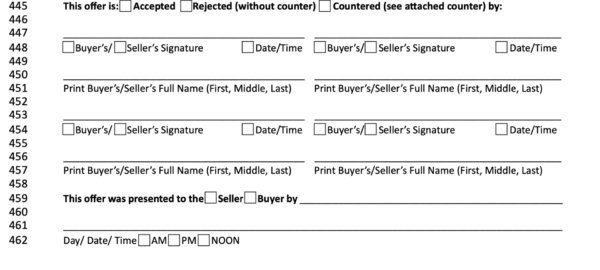

The receiving party must indicate whether they accept, reject, or counter the offer.

If there is a counteroffer, it should be attached to this original contract.

Buying and selling a house is a legal transaction – but we promise to make it easy on you!

Want to get listings and real estate info? Sign up for our newsletter!